13 AUG 2020

Making Green Bonds work for Planet and People

Launch of new report on environmental and social benefits of green bonds in Asia

A new research report by Oxfam Hong Kong and Carbon Care Asia has found that only one in four green bond issuers offered details on how to identify environmental impact, and less than one in ten explained how they manage environmental risks. This revelation comes in the midst of an exponential growth of green bonds as more and more investors are convinced that green assets are a better class of defensive investment in market downturns.

Green bonds are seen as an important tool to shift money flows to environmentally friendly projects, and to achieve the carbon reduction targets under the Paris Climate Agreement. In 2019 there were US$259 billion new issues in the global green bond market, and its growth in Asia Pacific has jumped by 29%.

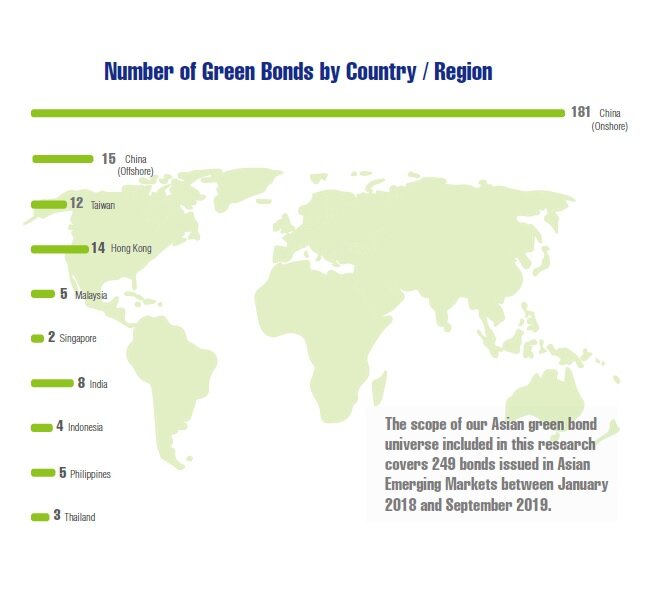

The Oxfam report entitled “Making Green Bonds Work: Social and Environmental Benefits at Community Level” has analysed 249 green bonds issued in Asian emerging markets (Japan, Korea and Australia excluded) between January 2018 and September 2019, with an aggregate issue amount of US$84 billion. It aims to answer two questions increasingly asked by sustainability-conscious investors and civil society organisations: how much have green bonds contributed to the stated environmental goals, and has there been adequate attention placed on the social impact of projects funded by green bonds.

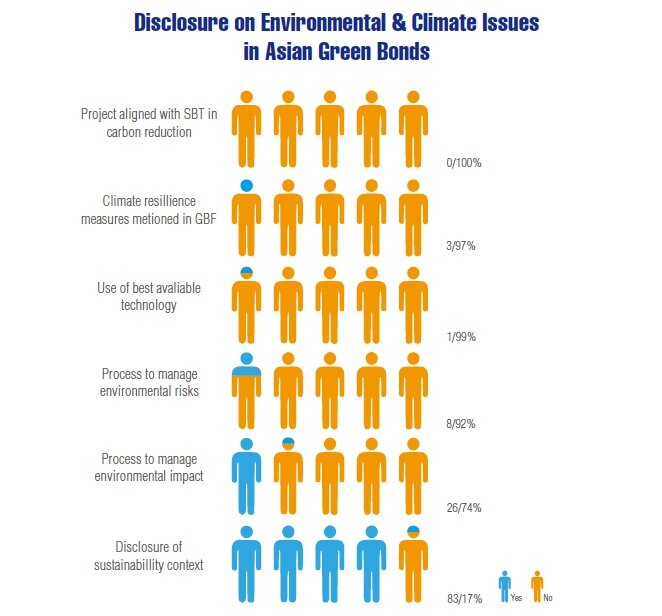

The researchers from Carbon Care Asia found that 83% of the issuers disclosed the sustainability context of their bonds, yet only 3% of issuers mentioned climate resilience measures in the green bond frameworks despite claiming to contribute to climate goals, and a mere 1% indicated that they adopted best available technology in project design.

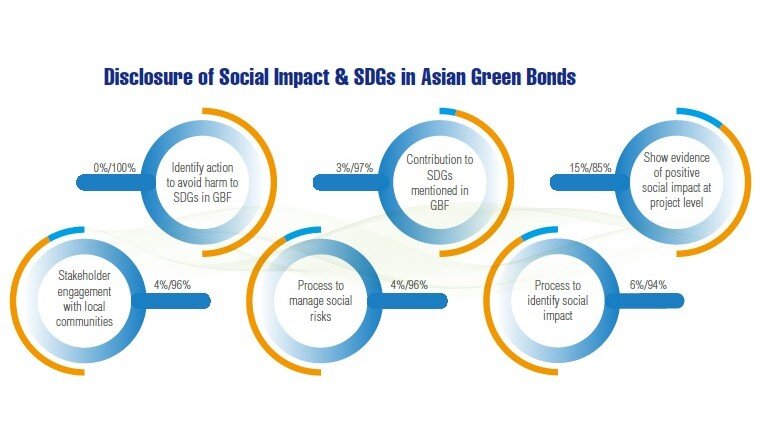

As far as local communities are concerned, only 6% of green bond issuers adopted a process to identify the social impact of their bonds and 4% embraced a process to manage social risks. Whilst 15% attempted to show some evidence of positive social impact, only 3% mentioned some contributions to the UN Sustainable Development Goals (SDGs) in the green bond frameworks.

Mayling Chan, International Programme Director at Oxfam Hong Kong commented: “Although green bonds do not embed explicit social goals in their design, there is high expectation in the investor community that they, at the minimum, do not have any negative social impact. None of the green bonds in the study had identified action to prevent negative impact on the UN SDGs. We urge green bond issuers to embed more social safeguards in their issuance so that vulnerable communities in developing countries, such as villagers affected by hydropower dams or onshore windfarms, do not suffer from unintended consequences.”

“There is emerging evidence that green bonds are retaining value better than mainstream corporate debt during times of crisis. While this spurred more investor interest, we need to ensure that green bonds remain true to their original purpose: accelerating the global transition to a low-carbon economy. We have identified not just shortfalls but also quite a few best practices, which offer good insights for all stakeholders to raise their game and secure healthy growth for the industry,” added Albert Lai, CEO of Carbon Care Asia.

John Sayer, Director of Carbon Care Asia and Senior Advisor to the research project, said: “Each one-degree rise in average global temperature puts an additional one billion people outside the optimal climate zone for food production and outdoor work. There is an urgency to improve the standards and practices of green and climate bonds. The next step of our work will engage key stakeholders to build a consensus on how to move green finance forward in the context of the UN Sustainable Development Goals. Collaboration and improvement are important for limiting global warming to 1.5C, as the science behind the Paris Climate Agreement tells us we must do.”

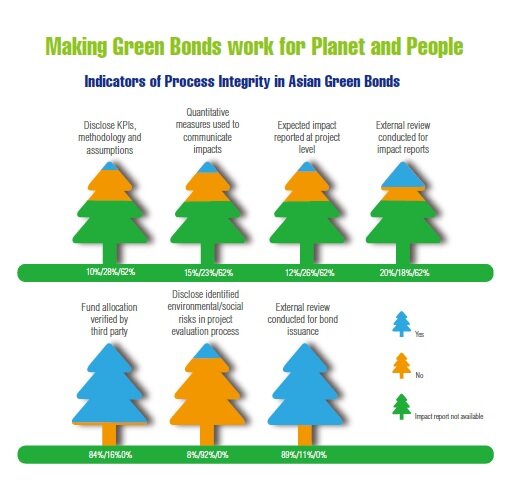

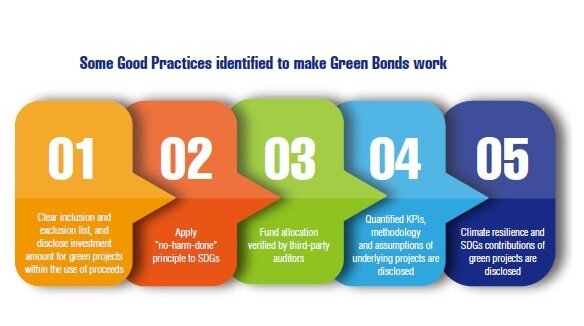

In view of the research findings, Oxfam Hong Kong and Carbon Care Asia offered a range of recommendations on how to improve the standards and practices of the green bond market.

Some of the key recommendations include the assessment and disclosure of environmental contributions through quantitative measures; use of best available technologies to maximise environmental benefits and minimize social risks; application of the do-no-harm principle to UN SDGs; assessment of climate resilience; community engagement at various stages of the project cycle; and the adoption of science-based targets for carbon reduction.

The report has outlined a stakeholder engagement plan for the next phase of research, for which potential supporters and partners are invited to contact the organisers to discuss collaboration opportunities.

A webinar for the launch of the Oxfam Report will be held on August 13th at 16:00-17:30 HKT,SGT/ 9am BST /10am CEST. Members of the media are welcome to register:

https://us02web.zoom.us/webinar/register/WN_SnsQw2p3S72dO-YrkyOi2w

-End-

About Oxfam

Oxfam is a worldwide development organisation that mobilises the power of people against poverty. Around the globe, Oxfam works to find practical, innovative ways for people to lift themselves out of poverty and thrive. We save lives and help rebuild livelihoods when crisis strikes. And we campaign so that the voices of the poor influence the local and global decisions that affect them.

About Carbon Care Asia

Operating from Hong Kong and Singapore, Carbon Care Asia is a mission-driven consultancy in corporate sustainability, carbon strategy, climate competence and sustainable finance. CCA offers integrated solutions to manage risks and capture business opportunities whilst tackling sustainability challenges and responding to the climate emergency. Since its establishment in 2008, CCA has served over 200 Asian companies in pursuit of its mission to accelerate the transition to a net-zero carbon economy benefitting all.

For media enquiries:

Oxfam Hong Kong:

Sarah Chu, Acting Communications Manager, +852 31205280, [email protected]

Clara Law, Communications Officer, +85231205272, [email protected]

Carbon Care Asia:

(Hong Kong) Lorène Delhoume, Senior Sustainability Analyst, +852 25415020, [email protected]

(Singapore) Estella Ho, Sustainability Officer, +65 92344717, [email protected]