IntroductioN

_ Living Wage

Charter Research and

Resources list of Living Wage

Employers

Application

Form: become A living wage employer FAQ

_ Support

us Contact

Us

no less than $62.8 /hour

living wage as of april 2025

Background

The Living Wage initiative is a global movement that originated from the UK in 2011. A living wage refers to the salary an employee earns that not only allows them and their family members to meet their basic needs, but also enables them to live a decent life. This includes being able to afford a balanced diet, reasonable living space, social life, education, health care and being able to save up for an emergency. Paying a living wage would also ensure low-income households are able to move towards economic mobility.

In 2018, Oxfam Hong Kong commissioned The Chinese University of Hong Kong to conduct research on the Living Wage in Hong Kong – the first of its kind in the city. The latest living wage standard for 2025 in Hong Kong is set at HK $62.8/hour. OHK reviews the Living Wage standard annually, using the CPI(A), and announces any revisions in the first quarter of the year. Living Wage Employers will then have a six-month period to adjust the salaries of their direct employees.

Oxfam recognises employers who pay a living wage and will award the 'Living Wage Employer Logo' to acknowledge their responsible wage policy. This logo can be used on eligible applicants' social media, websites, or other promotional materials. Employers can apply for the 'Living Wage Employer Logo' on this page. If you have any questions, please contact us by email at [email protected] or call us on 3120 5292.

Case Study: Living Wage Transformation at HKUST

HKUST

started paying its cleaning staff a living wage. Watch the video to see why this is not only good for employees, but also a very good business case.

Let's support the Living Wage together!

Become a Living Wage

Employer Today donate

Why is it necessary to implement a living wage in Hong Kong now?

- The labour market has been impacted by the pandemic

Since the outbreak of the pandemic, the labour market in Hong Kong has faced critical challenges, resulting in a skill mismatch in the post-pandemic period. There is clearly a long journey ahead before we fully recover. Many employers have expressed concern about recruitment as they have found it very difficult to hire and retain staff due to the labour shortage. At the same time, however, many workers’ livelihoods have been severely impacted because of the statutory minimum wage freeze over the past four years. Although it will be raised to $42.1/hour beginning 1 May 2025, it might not sufficiently make up for inflation, especially in terms of food and energy. If workers’ wages are not enough to cover their basic cost of living, and transportation costs or other costs they need to bear to go to work, this will deter potential workers from joining the workforce. This will in turn worsen the labour shortage, creating a vicious cycle in Hong Kong. A living wage, on the other hand, ensures workers can lead a decent life, and would thus attract economically inactive individuals to return to the workforce and alleviate the labour shortage. - The living wage is a remedy to a dilemma and creates a win-win situation

It is high time employers pay their employees a living wage. On the one hand, doing so would alleviate the problem of working poverty by providing employees with fair wages. On the other, employers could recruit and retain talent more easily, and workers would more likely be committed to their jobs as well. Moreover, Generation Z and millennials generally place more emphasis on a company’s values; by paying a Living Wage, employers can show their commitment to paying fair wages and attract more young talents to join their company. All around, there are many solid reasons for why a Living Wage would create a win-win situation for both employers and employees and address the labour shortage in Hong Kong.

Living Wage standard across the years

| YEAR | LIVING WAGE (HK$ PER HOUR) | STATUTORY MINIMUM WAGE (HK$ PER HOUR) |

|---|---|---|

| 2025 | 62.8 | 42.1 |

| 2024 | 61.5 | 40 |

| 2023 | 60.1 | 40 |

| 2022 | 58.9 | 37.5 |

| 2021 | 57.1 | 37.5 |

| 2020 | 57.4 | 37.5 |

| 2019 | 54.7 | 37.5 |

| 2018 | 54.7 | 34.5 |

How is the Living Wage calculated?

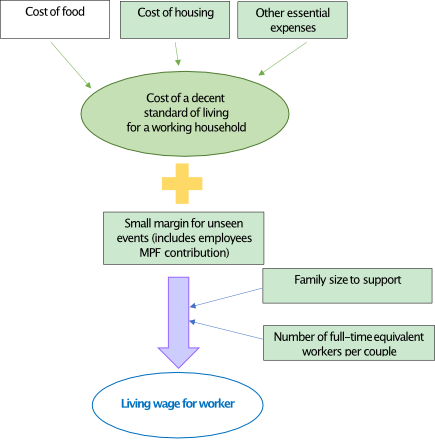

1. The Living Wage figure in 2018

OHK commissioned CUHK to conduct the Living Wage research using the globally recognised Anker Living Wage Method. Under this method, the Living Wage is defined as 'remuneration received for a standard work week by a worker in a particular place sufficient to afford a decent standard of living for the worker and her or his family. Elements of a decent standard of living include food, water, housing, education, health care, transport, clothing, and other essential needs, including provision for unexpected events'. Please refer to the graph below to learn more about how the Living Wage was determined in 2018. For more information about the study in 2018, please visit this link.

Flow chart of the method for estimating a living wage

2. The Living Wage figures from 2019-2023

Using the figure from 2018 as a base, OHK revised the Living Wage standard annually with reference from CPI(A) in Hong Kong. We calculated the percentage change of CPI(A) every year, and adjusted the Living Wage Standard accordingly.

What is the difference between Living Wage and Statutory Minimum Wage?

Since the Living Wage is still a relatively new concept in Hong Kong, there’s often a bit of confusion about what it is and how it differs from the minimum wage. One of the main differences is their purpose. The Living Wage ensures workers earn enough to lead dignified lives for both themselves and their families, thus alleviating working poverty. A minimum wage, however, does not look holistically at workers’ needs, but aims only to strike a balance between excessively low wages and minimising the loss of low-paying jobs. The minimum wage is also a statutory requirement, while employers pay a Living Wage on a voluntary basis and are not required by law to do so. As you can see, the Living Wage was developed using a people-oriented perspective, while the minimum wage looks at wages from an economic standpoint.

| Living Wage | Minimun Wage | |

|---|---|---|

| Wage per hour (as of 2025) | HK$62.8/hour | HK$42.1/hour |

| Nature | Voluntary | Statutory |

| Purpose | A Living Wage ensures workers earn enough to lead dignified lives for both themselves and their families, thus alleviating working poverty | A minimum wage aims to forestall excessively low wages and minimise the loss of low-paid jobs, and give due regard to sustaining Hong Kong’s economic growth and competitiveness. |

| Focus | People-oriented | Economic |

What is counted and not counted towards the Living Wage?

| Items | Is it Counted? |

|---|---|

| 1. Employers’ contribution to the MPF | |

| 2. Bonuses | |

| 3. Non-monetary rewards | |

| 4. One-off rewards or gratuities | |

| 5. Commission* |  |

| 6. Allowances# |  |

| 7. Statutory entitlements (e.g. annual leave pay)^ |  |

*Commission that is paid, with prior agreement of your staff, and constitutes a large part of that staff’s salary, can be counted towards the Living Wage, under the condition that the employer guarantees to top up staff’s salary to the living wage level if the total pay including commission falls below the Living Wage.

#Allowances (e.g. transportation allowances), which are offered on a regular basis could count towards the Living Wage at employers’ discretion.

^Statutory entitlements under the Employment Ordinance (e.g. holiday pay, annual leave pay, sickness allowance, maternity leave pay, severance payment, long service payment, etc.) are calculated according to the definition of wages and should count towards the Living Wage.

Who Does the Living Wage apply to?

| Items | Is it Counted? |

|---|---|

| 1. Directly employed full time/part time/temporary contract staff |  |

| 2. Outsourced staff who regularly work on your premises for at least 18 hours a week ** |  |

| 3. Written and oral contracts of employment |  |

| 4. Staff with disabilities |  |

| 5. Suppliers/vendors who supply your organization with products, or engage under one-off service contracts and paid by a lump sum amount | |

| 6. Staff not directly employed or outsourced by your company | |

| 7. Self-employed workers | |

| 8. Student interns | |

| 9. Apprentices registered under the Apprenticeship Ordinance (Cap.47) |

** The Living Wage also applies to outsourced staff who regularly work on your premises for at least 18 hours a week by phases within 2 years. This includes, but is not limited to, contracted catering, cleaning, security, gardening and ground staff.

How would a living wage benefit me?

Testimonials from employees after receiving a Living Wage

(Quotes from our latest research report in 2022)

- 'The sense of belonging to the company has increased because of the recognition and affirmation received from the company/superiors. At the same time, because of knowing that one's effort will be recognised, one will be more willing to work hard.'

- 'With the increase in salary and the knowledge that the salaries for the same position in the job market are not as high, the intention to change jobs is lower, and the desire to continue developing in this field is higher.'

- 'Overall living conditions have improved, with higher salaries and reduced economic pressure, leading to more disposable income.'

- 'Inflation is very serious, and it is extremely difficult to live with the minimum wage level. If there is a living wage, the overall quality of life can be improved by 50 per cent. At the very least, it can serve as a subsidy, and the extra money can be saved or used for other purposes, such as leisure and entertainment. Housing expenses can also be improved with a living wage, without having to worry about the budget.'

How does the Living Wage help you achieve your SDGs commitment?

The Living Wage is closely related to three of 17 of the UN’s Sustainable Development Goals (SDGs). This is a great chance for companies to show their commitment to the SDGs and ESG/sustainable development, especially with regards to the ‘social’ pillar.

What has Oxfam done so far / what does Oxfam have planned?

2025

2025

- The Living Wage standard adjusted to $62.8/hour in 2025

2024

2024

- Review the Living Wage Initiative progress and plan for the next phase

2024

- The Living Wage standard adjusted to $61.5/hour in 2024

2023

2023

- Collaborate with the Living Wage Foundation in the UK to work on the Living Wage Week in November

2023

- The Living Wage standard adjusted to $60.1/hour in 2023

2023

- Strengthened connection with private sector to gain support for the Campaign

2023

- Official launch of the Living Wage Campaign and the official website

2022

2022

- Oxfam reviewed and revised the Living Wage to $58.9 in 2022

2021

2021

- Finalised the Charter and built an accreditation system to grow the Living Wage community

2020

2019 / 2020

- Oxfam advocated the Living Wage on social media and engaged employers across sectors

2018

2018

- The research suggested that the Living Wage in Hong Kong should be $54.7 as of 2018

2018

- Oxfam commissioned CUHK to conduct the pioneer Living Wage research in Hong Kong

Let's support the Living Wage together!

Become A Living Wage

Employer today donate